Employment Search Advice

- Your story – This should be brief but let people know who you are and get a sense of what value you could bring to their organisation.

- Why you are interested in that organisation and the role.

- What does the company do? Who is the CEO? Who are their main competitors? What is their culture?

- Why would you be a good fit for the company and the role? (Think about what you can do for them, not what they can do for you)

- Ask questions – Be engaged in every conversation and don’t be afraid to ask questions.

- Get to know as many people as possible – Find out all who has been really successful in your role previously and reach out to them to ask them what worked well for them. It will also be beneficial to reach out to other areas within the business to understand what they do that way you can see how it all fits together. You will find that you will pull little bits of advice from each person to make up your own formula for success that works for you and that you hopefully can share one day.

- Ask for feedback – It’s so important to OWN YOUR OWN DEVELOPMENT. You can’t improve on something if you don’t know what needs to be worked on. Ask your customers, ask your superiors, ask your colleagues, and your clients for feedback and you will quickly learn tricks of the trade that will set up for success and put you miles ahead of anyone else. *Remember when asking for feedback, be open, acknowledge it and then figure out the best way to apply it. Take advantage of all company resources too as they always have many tools available to help you be the best at your job.

- Realize also that every job will have its challenges. Indeed, the challenges should be seen as opportunities to learn and sometimes that learning will be difficult. As John W Gardner notes:

May it release within you wellsprings of

refreshment, inspiration and excitement.

May you be present in what you do.

May you never become lost in bland absences.

May the day never burden.

May dawn find you awake and alert,

approaching your new day with dreams, possibilities and promises.

May evening find you gracious and fulfilled.

May you go into the night blessed, sheltered and protected.

May your soul calm, console and renew you.

Recent Blog

MBA Program Sydney: CRICOS Approved Business Degree at NAPS

When choosing to pursue a business degree in Australia, discerning students look for more than just classroom learning—they seek qualifications that deliver global recognition, real-world impact, and career mobility. The MBA program at the National Academy of Professional Studies (NAPS) in Sydney stands out not only for its rigorous curriculum, but also for its coveted CRICOS approval, ensuring that international students gain a degree acknowledged throughout Australia and far beyond.

Why CRICOS Approval Matters

CRICOS (Commonwealth Register of Institutions and Courses for Overseas Students) approval is a pivotal indicator of quality and compliance in Australia’s education sector. MBA programs with this designation, such as NAPS’s, are specifically tailored for international students, delivering education that meets strict standards for teaching, facilities, and support services.

A CRICOS-approved MBA signals to employers and global institutions that your degree adheres to the Australian Qualifications Framework (AQF)—a benchmark for advanced business acumen and managerial skills instantly recognized worldwide. International graduates from such programs not only fulfil visa requirements, but also position themselves as strong contenders in competitive job markets.

NAPS MBA: Curriculum Built for Modern Leaders

The MBA program at NAPS is structured to cultivate visionary leaders who excel in dynamic, interconnected economies. Unlike generic business degrees, the NAPS curriculum seamlessly integrates theory with hands-on applications. Topics span strategic management, global marketing, innovation, ethics, and digital transformation—areas central to today’s business success.

What truly sets NAPS apart is the emphasis on soft skills and real-world leadership. Group projects, case studies, and industry simulations foster decision-making, negotiation, and critical thinking. Students engage in networking sessions and live projects with corporate partners to ensure they graduate ready not just for the boardroom, but for global change.

World-Class Sydney Campus Experience

Sydney is more than a world-class city—it’s a thriving business hub where cultures, sectors, and ideas intersect. NAPS’s campus in central Sydney gives MBA candidates direct access to Australia’s top employers, entrepreneurial events, and industry mentors. Students benefit from modern facilities, collaborative learning spaces, and a vibrant multicultural student body that reflects the broader business landscape of New South Wales and the Asia-Pacific.

Pathways to Career Success

Graduates of the NAPS MBA are equipped to lead in consulting, multinational corporations, government, and emerging tech startups. The CRICOS-approved degree is recognized by professional bodies, bolstering eligibility for positions that require advanced business qualification, project management expertise, and strategic vision.

NAPS’s extensive career support—including interview coaching, CV workshops, and networking introductions—ensures MBA graduates enter the workforce with confidence. Many alumni report faster promotions, superior mobility between global markets, and successful transitions into executive roles both in Australia and internationally.

The NAPS Edge: Industry Engagement and International Recognition

Not only do NAPS MBA students learn from academics with global consulting experience, but they also interact with professionals through partnerships and events. Industry input shapes coursework, keeping graduates ahead of trends in digital business, finance, ethical leadership, and cross-border management.

International students, in particular, praise the welcoming, supportive atmosphere that helps them adapt and thrive in Sydney’s cosmopolitan business environment.

How to Join NAPS’s MBA Program

The admission requirements for prospective candidates include meeting specific academic and English language criteria. However, the admissions team provides personalized guidance to help applicants through every step of the process. With multiple intakes offered throughout the year, students can choose flexible start dates and complete their studies at a pace that best supports their career goals.

Applying is straightforward: Submit your academic transcripts, proof of English proficiency, and a detailed resume. Interviews and references can further reinforce your fit for advanced business study at NAPS.

Why Should You Consider NAPS for Your MBA?

Choosing the right institution for your MBA can shape your professional future — and that’s where NAPS stands out. Here’s why pursuing your MBA at NAPS could be one of the most rewarding decisions for your career.

- CRICOS approved for global recognition

- Located in Sydney, a leading international business city

- World-class faculty and innovative curriculum

- Strong industry connections and project-based learning

- Dedicated support for international students

- Proven graduate outcomes in leadership and growth

In the crowded field of MBA education, the NAPS offering in Sydney is not just another business degree—it’s a launchpad for leaders ready to make an impact across industries and continents.

Ready to take the next step in your international business career? Contact NAPS today to learn how their CRICOS-approved MBA program can unlock your leadership potential and global opportunities.

Master of Information Technology Sydney: Build a Future-Ready Tech Career at NAPS

In a world where technology drives innovation across every industry, the demand for skilled IT professionals continues to soar. The Master of Information Technology (MIT) program at the National Academy of Professional Studies (NAPS) in Sydney equips students with advanced technical expertise, problem-solving ability, and global career readiness — preparing them to thrive in today’s fast-evolving digital world.

Why Choose a Master of Information Technology in 2025

Technology lies at the heart of every business transformation. From artificial intelligence and cloud computing to cybersecurity and big data, IT professionals are shaping the future of how organizations operate. Pursuing a Master of Information Technology positions you at the forefront of this global digital revolution.

In Australia, the IT sector continues to grow rapidly, creating thousands of new jobs each year. Graduates with advanced IT qualifications enjoy high employability, strong earning potential, and the flexibility to work across diverse industries — from finance and healthcare to software development and consulting.

Master of Information Technology at NAPS: Advanced, Practical, and Globally Relevant

The NAPS Master of Information Technology program blends academic rigor with real-world application. Designed with input from industry professionals, it equips students with both the technical and strategic skills employers value most.

Students gain in-depth knowledge across:

- Software engineering and application development

- Data analytics and database systems

- Cloud computing and virtualization

- Artificial intelligence and machine learning

- Cybersecurity and network management

- IT project management and enterprise systems

With hands-on labs, industry simulations, and project-based learning, NAPS ensures that graduates can apply their knowledge effectively to real business challenges.

What Makes the NAPS Master of Information Technology Stand Out

NAPS offers a unique blend of academic excellence and industry relevance, preparing students for success in competitive IT environments.

- Industry-Linked Curriculum: Every subject is aligned with current technology standards, ensuring graduates possess practical, up-to-date expertise.

- Flexible Learning Options: With multiple intakes throughout the year, NAPS allows students to start when it suits them best — whether studying full-time or part-time.

- Real-World Experience: Students engage in capstone projects, internships, and networking events, building valuable industry connections before graduation.

- Personalized Support: From application to career preparation, NAPS provides dedicated academic and career guidance every step of the way.

Career Outcomes After the Master of Information Technology

Graduates of the NAPS Master of Information Technology program are equipped for diverse, high-growth roles such as:

- IT Manager

- Software Engineer

- Data Analyst / Data Scientist

- Network Engineer

- Cloud Solutions Architect

- Cybersecurity Specialist

- IT Project Manager

- AI / Machine Learning Engineer

With Australia’s growing digital economy and ongoing investment in innovation, NAPS MIT graduates are in demand across multiple industries — both locally and internationally.

Future-Focused and Industry-Ready

As technology evolves, so does the NAPS Master of Information Technology curriculum. Students explore emerging trends like AI integration, blockchain innovation, cloud migration, and data ethics, ensuring they stay ahead of the curve and future-ready for tomorrow’s IT challenges.

Why Choose NAPS for Your Master of Information Technology

Choosing NAPS means choosing a university that connects learning with career outcomes.

- Industry-driven curriculum and practical project work

- Experienced faculty with global IT expertise

- Access to cutting-edge labs and innovation spaces

- Career support including resume workshops and employer introductions

- Flexible study schedules for domestic and international students

- Growing alumni network in Australia’s tech and business sectors

Conclusion: Your Future in IT Starts Here

The future belongs to those who can innovate with technology — and the Master of Information Technology at NAPS gives you the skills, confidence, and global outlook to lead that future. Whether you’re advancing your career or entering the IT field for the first time, NAPS provides the platform to turn your ambition into achievement.

Take the Next Step

Ready to build your career in technology? Apply now to the Master of Information Technology at NAPS Sydney and join a community of innovators shaping the future of the digital world.

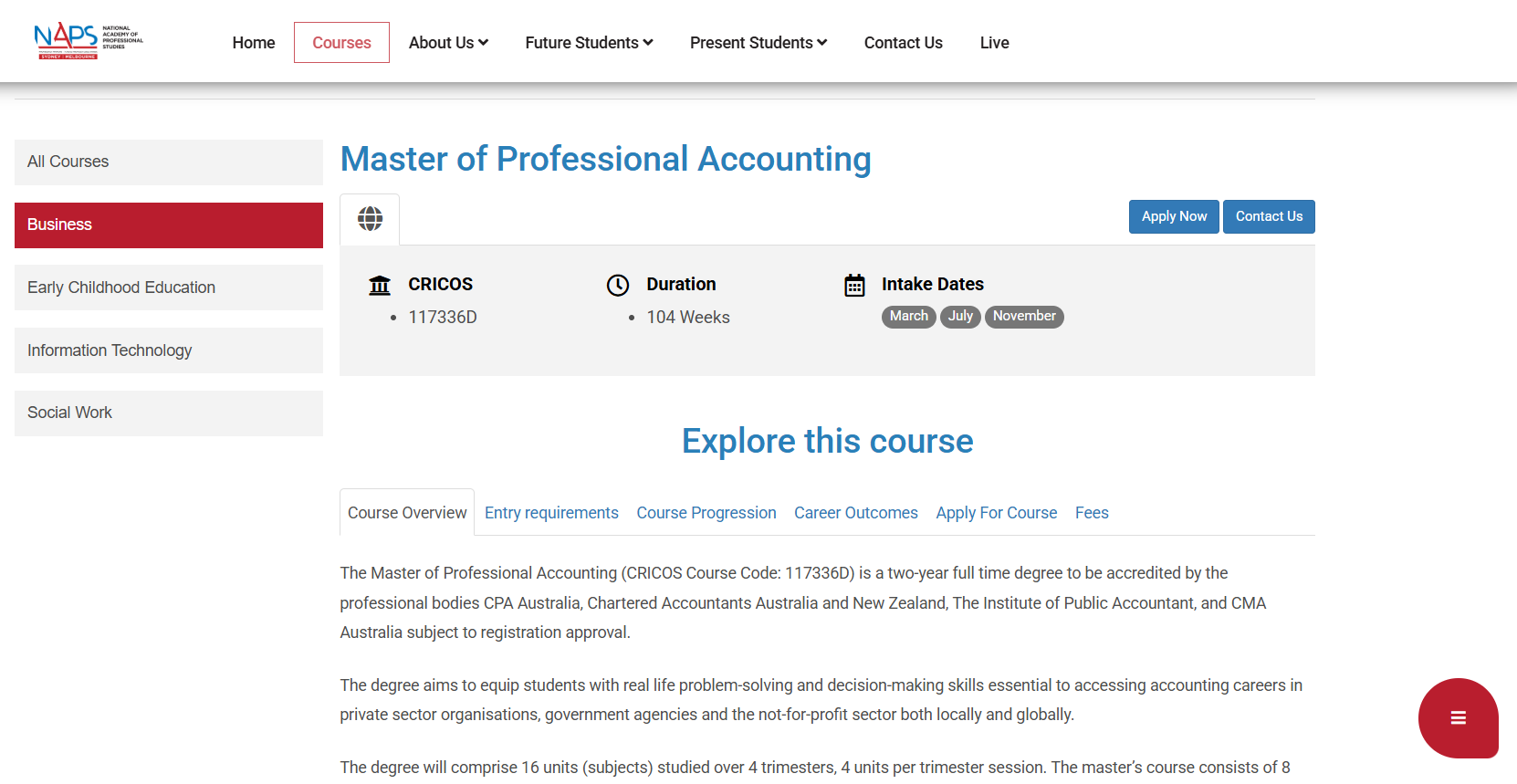

Master Professional Accounting: Fast Track to CPA

The accounting profession in Australia is experiencing unprecedented growth, with demand for qualified professionals reaching new heights in 2025. For ambitious individuals seeking a direct pathway to becoming a Certified Practising Accountant (CPA), the Master of Professional Accounting stands as the most strategic educational investment available today.

Australia's robust economy and complex regulatory environment have created an insatiable appetite for skilled accounting professionals. Recent data shows accounting positions are expected to grow strongly over the next five years, with salaries for qualified CPAs averaging $85,000-$120,000 annually for mid-level professionals. This demand isn't just local – Australian accounting qualifications are globally recognized, opening doors across international markets.

Why Master Professional Accounting Outperforms Bachelor DegreesUnlike traditional bachelor programs that cover broad business concepts, the Master of Professional Accounting is laser-focused on professional competencies. This specialized approach means graduates enter the workforce with immediately applicable skills rather than theoretical knowledge that requires years of practical experience to become valuable.

The program structure typically covers advanced financial reporting, auditing principles, taxation law, management accounting, and corporate governance. These subjects directly align with CPA Australia's educational requirements, eliminating the need for additional bridging courses that bachelor graduates often face. Students save both time and money while gaining deeper expertise in critical areas.

Most importantly, the Master of Professional Accounting functions as a conversion degree, welcoming students from diverse academic backgrounds. Whether you studied engineering, arts, or science, this program transforms your existing knowledge into accounting expertise. This diversity actually strengthens graduates' problem-solving abilities, as they bring unique perspectives to traditional accounting challenges.

The CPA Fast Track AdvantageAchieving CPA status traditionally requires completing specific educational requirements, gaining relevant work experience, and passing professional examinations. The Master of Professional Accounting accelerates this timeline significantly by satisfying all educational prerequisites in a condensed timeframe.

Professional accounting bodies including CPA Australia, Chartered Accountants Australia and New Zealand (CA ANZ), and the Institute of Public Accountants (IPA) have accredited quality programs to ensure graduates meet industry standards. This accreditation means employers immediately recognize the qualification's value, often leading to higher starting salaries and faster career advancement.

The program's practical focus also provides networking opportunities that prove invaluable for career development. Many institutions maintain strong industry connections, facilitating internships, guest lectures from senior practitioners, and recruitment events where students connect directly with potential employers.

Career Pathways Beyond Traditional AccountingModern accounting professionals operate far beyond basic bookkeeping and tax preparation. Today's CPAs function as strategic business advisors, helping organizations navigate complex financial decisions, regulatory compliance, and performance optimization. The Master of Professional Accounting prepares graduates for these evolved responsibilities.

Corporate accounting roles now encompass business intelligence, financial planning and analysis, risk management, and sustainability reporting. Government positions offer stability while contributing to public sector financial management and policy development. Public practice provides variety, working with diverse clients from small businesses to multinational corporations.

Emerging areas like forensic accounting, environmental accounting, and blockchain auditing represent exciting opportunities for tech-savvy graduates. These specialized fields often command premium salaries while offering intellectually stimulating career paths that didn't exist even five years ago.

Choosing the Right InstitutionNot all Master of Professional Accounting programs deliver equal value. When evaluating options, prioritize institutions with strong industry connections, experienced faculty, and comprehensive student support services. NAPS offers a Bachelor of Business (Accounting) that provides excellent foundational knowledge before advancing to master's level studies.

Look for programs that emphasize practical application through case studies, internships, and real-world projects. The best institutions also provide career counseling, resume workshops, and interview preparation to ensure graduates successfully transition into professional roles.

Accreditation by relevant professional bodies remains non-negotiable. This recognition ensures your qualification meets industry standards and facilitates professional membership applications. Additionally, consider the institution's reputation among employers, as prestigious alumni networks often provide career advantages that extend well beyond graduation.

The Master of Professional Accounting represents more than an educational qualification – it's a strategic career investment that delivers both immediate opportunities and long-term professional growth. For motivated individuals seeking the fastest route to CPA certification and accounting success, this specialized program provides unmatched value in today's competitive market.

Transform your career potential today – contact NAPS to learn how our accredited accounting programs can unlock your CPA pathway.

Islamic Business vs Traditional: Australia Career Boom

Australia's business landscape is experiencing a remarkable transformation as Islamic business principles gain mainstream recognition and adoption. The growing halal economy, valued at over $2.3 trillion globally, presents unprecedented career opportunities for graduates who understand both Islamic and conventional business frameworks.

This shift reflects Australia's increasingly diverse population and economy, where multicultural competency has become a valuable professional asset. Forward-thinking organizations recognize that Islamic business principles – emphasizing ethical conduct, social responsibility, and sustainable practices – align perfectly with modern corporate values and ESG (Environmental, Social, and Governance) priorities.

Understanding Islamic Business PrinciplesIslamic business operates on fundamental principles that differ significantly from purely profit-driven traditional models. The concept of halal (permissible) extends beyond food products to encompass ethical business practices, fair trading, and socially responsible investment strategies.

Key principles include prohibition of riba (excessive interest), gharar (excessive uncertainty), and gambling-related activities. Instead, Islamic business emphasizes profit-sharing, asset-backed financing, and risk-sharing partnerships. These principles create more stable, community-focused business models that have proven remarkably resilient during economic downturns.

The concept of maslaha (public interest) drives Islamic businesses to consider broader social impacts beyond shareholder returns. This holistic approach resonates with younger consumers and employees who increasingly prioritize purpose-driven organizations over purely profit-maximizing entities.

Traditional Business Model LimitationsConventional business education often focuses narrowly on profit maximization, shareholder primacy, and competitive advantage. While these concepts remain important, they represent incomplete approaches to modern business challenges.

Traditional models frequently struggle with sustainability concerns, social inequality, and long-term stakeholder relationships. The 2008 financial crisis and subsequent economic challenges highlighted the risks of purely profit-driven decision-making without considering broader consequences

Many traditional businesses now actively seek professionals who understand alternative business frameworks that can complement conventional approaches. This demand creates significant opportunities for graduates with Islamic business knowledge to provide fresh perspectives and innovative solutions.

Career Opportunities in Australia's Halal EconomyAustralia's halal economy encompasses far more than food certification and restaurant management. The sector includes halal tourism, Islamic finance, modest fashion, halal pharmaceuticals, and ethical investment products. Each area offers distinct career pathways for qualified professionals.

Islamic finance represents one of the fastest-growing segments, with major Australian banks now offering Shariah-compliant products. Career opportunities include Islamic banking specialists, Shariah compliance officers, and ethical investment advisors. These roles typically command premium salaries due to specialized knowledge requirements.

The halal tourism sector capitalizes on Australia's appeal to Muslim travelers worldwide. Career opportunities span hotel management, tour operations, destination marketing, and cultural consulting. As Muslim populations grow globally, this sector's expansion potential remains enormous.

Competitive Advantages for Islamic Business GraduatesProfessionals with Islamic business education possess unique competitive advantages in today's market. They understand both conventional and alternative business frameworks, enabling them to serve diverse client bases and navigate complex multicultural business environments.

This dual competency proves particularly valuable in international business, where cultural sensitivity and ethical considerations increasingly influence success. Organizations expanding into Muslim-majority markets specifically seek professionals who understand local business customs and religious considerations.

The growing emphasis on corporate social responsibility and sustainable business practices aligns naturally with Islamic business principles. Graduates can articulate how traditional Islamic concepts apply to modern challenges like climate change, social inequality, and ethical governance.

Educational Pathways and Career DevelopmentNAPS offers a Bachelor of Islamic Business that provides comprehensive grounding in both Islamic and conventional business principles. This unique program prepares graduates for diverse career opportunities while maintaining cultural authenticity and religious integrity.

The curriculum typically covers Islamic commercial law, halal industry management, ethical finance, and cross-cultural business communication. Students also study conventional subjects like marketing, accounting, and operations management, ensuring broad professional competency.

Practical experience through internships with halal-certified businesses, Islamic financial institutions, and multicultural organizations provides real-world application of theoretical knowledge. These experiences often lead directly to employment opportunities as organizations recognize graduates' unique value propositions.

Future Growth ProjectionsIndustry analysts project continued expansion of Australia's halal economy, driven by demographic changes, increased consumer awareness, and growing acceptance of ethical business practices. This growth translates directly into career opportunities for qualified professionals.

The integration of Islamic business principles into mainstream corporate governance represents another significant trend. As organizations seek sustainable, ethical business models, professionals who understand these principles become increasingly valuable strategic assets.

Government initiatives supporting multicultural business development and international trade with Muslim-majority countries further enhance career prospects. These policies create supportive environments for Islamic business professionals to thrive and contribute to Australia's economic growth.

The choice between Islamic business and traditional business education isn't binary – the most successful professionals understand both frameworks and can apply appropriate principles to specific situations. This comprehensive knowledge positions graduates for leadership roles in Australia's evolving, multicultural business environment.

Bridge traditional and Islamic business expertise – contact NAPS today to discover how our specialized programs prepare you for multicultural career success.

Master in Professional Accounting in Australia – Your Pathway to a Global Career

Thinking about a high-impact career that opens doors not just locally but globally? The world of accounting offers stability, growth, and endless opportunities, and pursuing a Master in Professional Accounting in Australia could be your golden ticket. It’s a qualification designed to transform your career, whether you’re starting fresh or looking to gain the credentials you need to level up. But we know the path can seem complex, filled with questions about courses, careers, and requirements.

This guide is here to help you navigate it all with confidence. We’ll break down everything you need to know, from why Australia is the perfect place for your studies to the exact steps you can take to get started.

- First, we’ll explore why Australia is a top global destination for accounting education.

- Next, we will demystify the Master of Professional Accounting (MPA) degree itself.

- Then, you will discover the exciting and lucrative career paths this degree unlocks.

- After that, we'll guide you on how to choose the right program for your goals.

- Finally, we will provide a clear checklist to help you apply and succeed in your studies.

Why Choose Australia for Your Professional Accounting Master's?

Deciding where to invest in your education is a huge step, and it’s important to understand the benefits of your chosen destination. When you choose to study accounting in Australia, you’re not just signing up for a course; you’re stepping into a vibrant ecosystem built for your success. The country’s reputation for high-quality education is backed by a strong, growing economy that actively seeks skilled accounting professionals.

This combination of world-class learning and real-world demand makes Australia a strategic choice for anyone serious about building a successful accounting career. From gaining qualifications that are respected worldwide to enjoying an unmatched quality of life, the advantages are clear. Let’s explore exactly what makes Australia stand out on the world stage.

A Globally Recognised Qualification

One of the most significant advantages of completing a Master in Professional Accounting in Australia is the global recognition that comes with it. Australian universities and higher education providers are held to incredibly high standards under the Australian Qualifications Framework (AQF). This ensures that your degree is not just a piece of paper but a symbol of excellence respected by employers and professional bodies worldwide.

This global stamp of approval means your career opportunities aren't limited to Australia's borders. Whether you dream of working in London, Singapore, Toronto, or back in your home country, your Australian MPA will be a powerful asset. It signals that you have received a rigorous, modern, and comprehensive education in accounting principles and practices.

Strong Economic Growth and High Demand for Accountants

Australia’s economy is resilient and consistently growing, which directly fuels the demand for qualified accountants. According to the Australian Government's Job Outlook data, the number of Accountants is expected to grow strongly over the next five years. This creates a stable and promising job market for MPA graduates.

Businesses of all sizes, from innovative tech startups to multinational corporations and government agencies, rely on skilled accountants for financial management, strategic planning, and regulatory compliance. This constant need means that graduates with a professional accounting masters in Australia are highly sought after. You are entering a field where your skills are not just valued but essential for economic progress.

A Clear Pathway to Professional Accreditation

For many aspiring accountants, the ultimate goal is to become a Certified Practising Accountant (CPA) or a Chartered Accountant (CA). An accredited Master of Professional Accounting is the most direct pathway to achieving these prestigious credentials. Programs like the one offered at NAPS are designed to meet the educational requirements of CPA Australia, Chartered Accountants Australia and New Zealand (CA ANZ), and the Institute of Public Accountants (IPA).

This alignment is a game-changer because it streamlines your journey to becoming professionally certified. Instead of taking disparate bridging courses, your master’s degree covers the necessary foundational knowledge in areas like auditing, taxation, and financial reporting. This integrated approach saves you time, money, and effort on your path to full professional status.

What is a Master of Professional Accounting (MPA)? A Deep Dive

Now that you know why Australia is the place to be, let's look closer at the degree itself. The Master of Professional Accounting (MPA) is a specialised postgraduate program, and understanding its structure is key. Unlike general business degrees, professional accounting courses Australia are purpose-built to equip students with the specific technical skills and theoretical knowledge required for a career in accounting.

The MPA is often designed as a conversion degree, making it perfect for individuals from non-accounting backgrounds who want to pivot their careers. It’s an intensive, focused program that gets you job-ready in a relatively short amount of time. Let’s break down who it’s for and what you’ll learn.

Who is the MPA Designed For?

You might be surprised to learn that you don't necessarily need an undergraduate degree in accounting to enrol in an MPA. This is one of its greatest strengths! The MPA is ideal for two main groups of people:

- Career Changers: Individuals who hold a bachelor's degree in another field (like arts, science, engineering, or IT) and want to move into the stable and rewarding field of accounting.

- International Graduates: Students whose undergraduate accounting degrees from their home country are not recognised by Australian professional bodies and need a qualifying degree to pursue accreditation.

Essentially, if you have the ambition to become an accountant but lack the formal educational prerequisites, the MPA is your bridge to that goal. It provides all the foundational and advanced knowledge in one comprehensive package.

Core Subjects You'll Master

The curriculum of a Master in Professional Accounting in Australia is carefully structured to cover all the essential pillars of the profession. At NAPS, for example, the course ensures you develop a deep understanding of key areas that are critical for professional practice and accreditation. You can expect to dive into subjects such as:

- Financial Accounting: Learning how to prepare and interpret financial statements for companies.

- Management Accounting: Using financial data to make strategic business decisions.

- Auditing and Assurance: Understanding the process of verifying financial records for accuracy and compliance.

- Australian Taxation Law: Navigating the complexities of personal and corporate tax.

- Corporate Law: Grasping the legal frameworks that govern business operations.

- Data Analytics & AI in Accounting: Adopting modern technologies to analyze financial data for better business insights.

These subjects don't just teach you theory; they prepare you for the real-world challenges you’ll face as a professional accountant.

Unlocking Your Career: Job Opportunities After Graduation

Completing your MPA is just the beginning of an exciting journey. The skills you gain are universally applicable, making you a valuable asset in virtually every industry. An accounting career in Australia is not just about crunching numbers in a quiet office; it's about becoming a trusted advisor who helps organisations thrive in a complex financial landscape.

Your qualification opens doors to a wide variety of roles, each with its own unique challenges and rewards. From ensuring public companies are transparent to helping non-profits manage their funds effectively, your work will have a real impact. Here are some of the paths you can take.

In-Demand Roles for MPA Graduates

With a Master in Professional Accounting in Australia, you will be qualified for a range of specialised roles. You're not limited to one single job title. Here are just a few of the career paths that will be open to you:

- Financial Accountant: Responsible for maintaining financial records and preparing reports for external stakeholders like investors and regulators.

- Management Accountant: Works internally to provide financial information that helps managers make strategic decisions.

- Auditor: Can work for an accounting firm (external) or within a company (internal) to examine financial records for accuracy and compliance.

- Tax Accountant/Consultant: Specialises in tax law, helping individuals and businesses comply with regulations and minimise their tax liability.

- Forensic Accountant: Investigates financial discrepancies and fraud, often working with law enforcement agencies.

- Business Advisor: Uses financial expertise to provide strategic advice to businesses on growth, efficiency, and risk management.

Salary Expectations: What Can You Earn?

Of course, financial reward is an important factor when considering a new career. The good news is that accounting is a well-compensated profession in Australia, with strong potential for salary growth as you gain experience and professional certification.

While starting salaries can vary by location and company size, graduates with a master's degree can expect a competitive entry-level package. According to data from platforms like Seek and Payscale, graduate accountants in Australia can earn between $65,000 and $80,000 per year. With a few years of experience and a CPA or CA designation, this can quickly rise to over $100,000 and continue to grow from there.

Choosing the Right Program: What to Look for in an MPA

Not all MPA programs are created equal, and choosing the right one is crucial for your success. The ideal course should not only provide you with the necessary knowledge but also support you throughout your learning journey. When evaluating your options, consider factors beyond the curriculum, such as accreditation, flexibility, and the institution’s focus on practical success, which is where the NAPS accounting course truly shines.

Making an informed decision means looking for a provider that is genuinely invested in your future. You want a program that bridges the gap between the classroom and the workplace. Here are the key things to look for.

Accreditation and Industry Recognition

This is non-negotiable. Ensure the MPA program you choose is fully accredited by Australia’s key professional accounting bodies: CPA Australia and Chartered Accountants Australia and New Zealand (CA ANZ). This accreditation is your guarantee that the course content meets the high standards required for you to pursue professional certification after you graduate.

A program like the Master of Professional Accounting at NAPS is specifically designed with these accreditation requirements in mind. This saves you the headache of figuring out if you’ve met the prerequisites later on. It provides a seamless and clear pathway toward your professional goals.

The NAPS Advantage: A Focus on Real-World Success

Beyond just teaching theory, a great MPA program prepares you for the realities of the modern workplace. At NAPS, the focus is on creating job-ready graduates who can make an immediate impact. The curriculum for the Master in Professional Accounting in Australia is infused with real-world case studies and practical applications to ensure you can apply what you learn.

This approach means you're not just memorising formulas; you're learning how to solve real business problems. With experienced lecturers who bring their industry knowledge into the classroom, you gain insights that go beyond the textbook. This practical focus is what employers are looking for and what will set you apart in the job market.

Your Application Checklist: Steps to Enrol and Succeed

Feeling ready to take the next step? The application process can seem daunting, but breaking it down into manageable steps makes it much easier. To secure your place in a program, you’ll need to meet the entry requirements for master of accounting and prepare a thorough application. This checklist will guide you through the key stages.

Remember, preparation is key to a smooth and successful application. Start gathering your documents early and don’t hesitate to reach out to the institution’s admissions team if you have any questions. They are there to help you succeed.

Understanding the Entry Requirements

First, confirm that you meet the basic eligibility criteria. While this can vary slightly between institutions, the typical requirements for a Master of Professional Accounting in Australia include:

- A completed bachelor's degree from a recognised university in any discipline.

- Proof of English language proficiency for non-native speakers, usually through a test like IELTS or TOEFL.

- Some institutions may have a minimum Grade Point Average (GPA) requirement from your previous studies.

The NAPS admissions team can provide clear guidance on their specific entry requirements and help you assess your eligibility.

Preparing Your Application Documents

Once you’ve confirmed your eligibility, it’s time to gather your paperwork. A typical application package for a Master in Professional Accounting in Australia will require:

- Certified copies of your academic transcripts and degree certificate.

- Your English language test results (e.g., IELTS).

- A copy of your passport.

- A current curriculum vitae (CV) or resume.

- A personal statement or letter of intent, explaining why you want to pursue the degree.

Having these documents ready will make the online application process much smoother and faster.

Frequently Asked Questions (FAQs)

- Do I need a background in business or accounting to apply for an MPA?

No, you don’t! The Master of Professional Accounting is specifically designed as a conversion course. It’s perfect for graduates from any discipline—be it arts, sciences, or engineering—who want to pivot into an accounting career.

- Is a Master in Professional Accounting from Australia recognised internationally?

Absolutely. Australian qualifications are highly respected globally, and degrees accredited by CPA Australia and CA ANZ are recognised by professional bodies around the world. This gives you excellent career mobility.

- How long does it take to complete the degree?

Most Master of Professional Accounting programs in Australia, including the one at NAPS, are designed to be completed over 2 years of full-time study. This timeframe allows you to cover all the required knowledge for professional accreditation.

- What is the difference between an MPA and a Master of Finance?

An MPA focuses broadly on accounting principles, including financial reporting, auditing, taxation, and management accounting, preparing you to become a CPA or CA. A Master of Finance is more specialised, focusing on investments, financial markets, and corporate finance, leading to roles like financial analyst or investment banker.

- Can I work in Australia after completing my MPA?

Yes, many international students are eligible to apply for a Temporary Graduate visa (subclass 485) after completing their studies. This visa allows you to live, study, and work in Australia for a temporary period, giving you the chance to gain valuable local work experience.

- What are the typical fees for a Master in Professional Accounting in Australia?

Fees can vary between institutions. It's best to check the official website of the provider you're interested in, like the NAPS course page, for the most current and accurate fee information for both domestic and international students.

Conclusion: Your Future in Accounting Starts Today

Embarking on a Master in Professional Accounting in Australia is more than just an academic decision—it's an investment in a secure, rewarding, and globally mobile future. From gaining a world-class qualification to unlocking a direct pathway to professional accreditation and high-demand careers, the benefits are undeniable. We hope this guide has demystified the process and empowered you with the clarity and confidence to move forward.

The journey may seem long, but every successful career starts with a single, decisive step. You have the ambition, and with the right program and support, you can achieve your professional goals. The world of accounting is waiting for sharp, dedicated minds like yours.

Ready to take that first step? Our friendly team is here to answer your questions and guide you through the process.

Explore more with NAPS and get started on your pathway to success: https://www.naps.edu.au/contact-us